De-dollarization is a MEME

Ofc Trump has an opinion on this:

"If we lose our currency, that's the equivalent of losing a world war"

— PressTV Extra (@PresstvExtra) April 16, 2023

Former US President Donald Trump expresses grave concern over the de-dollarization trend taking over more and more countries around the world. pic.twitter.com/8Fnl1kNnhB

Statistics about USD dominance:

Share of payments:

"Dedollarization" Update. Data as of February 2023. pic.twitter.com/t5QnM7W0CB

— ʎllǝuuop ʇuǝɹq (@donnelly_brent) April 12, 2023

Share of forex reserves:

How de-dollarization works:

Watch this to understand the details:

The US saves little because the US has a trade deficit that's driven by excess savings elsewhere:

- Countries with open capital accounts cannot control the relationship between S and I.

Trade deficits benefit those with liquid capital (elites):

- When the US opened its capital account, surplus countries started investing there because Anglophone countries have the best legal infrastructure for capital inflows (60-80% of trade deficits belong to these countries).

As shown in the charts below, dollar hegemony in its current form is synonymous with anti-mercantilist policy, meaning it hollows out domestic industrial capacity in exchange for widening the external reach of the political+military influence of the country. https://t.co/lprjlbPeMc

— Lyn Alden (@LynAldenContact) March 30, 2023

Why China's Yuan isn't a thing

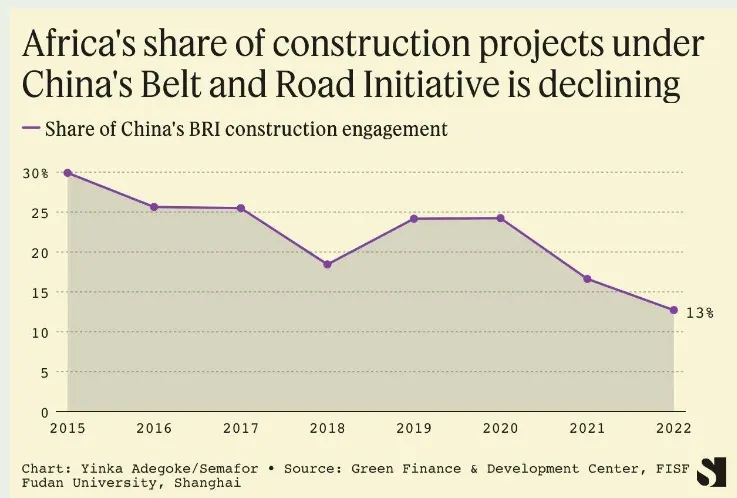

Recycling excess savings in developing countries is going down:

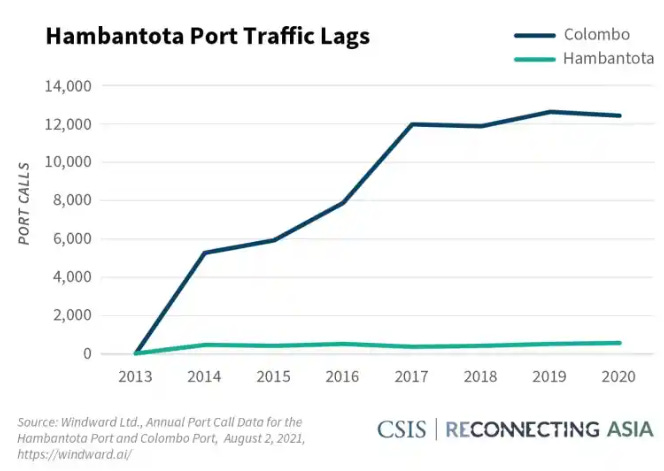

The ROI isn't there:

CNY bond market isn't liquid:

- China pays for its projects in USD because contractors want USD (easier to recycle).

BRICs are not politically aligned:

Russia won't settle trade with India in rupees because it runs a surplus with India and doesn't want to accumulate rupee claims. What matters is less the currency in which trade is denominated and more the one in which balances are accumulated.https://t.co/QhxUbNxMD3

— Michael Pettis (@michaelxpettis) May 5, 2023

- Chinese holdings of USTs is not equal to Chinese holdings of dollars.

- If Russia buys CNY now China has a lower surplus and can either reinvest that money domestically or boost their dollar holdings and they are boosting their holdings.

Conclusion:

- If US reduces dollar dominance it adds domestic demand and subtracts foreign demand.

- China wants more non-USD trade, but what matters is WHAT YOU DO WITH THE REVENUE.

- Crypto settlement is also a meme.

Who to follow: